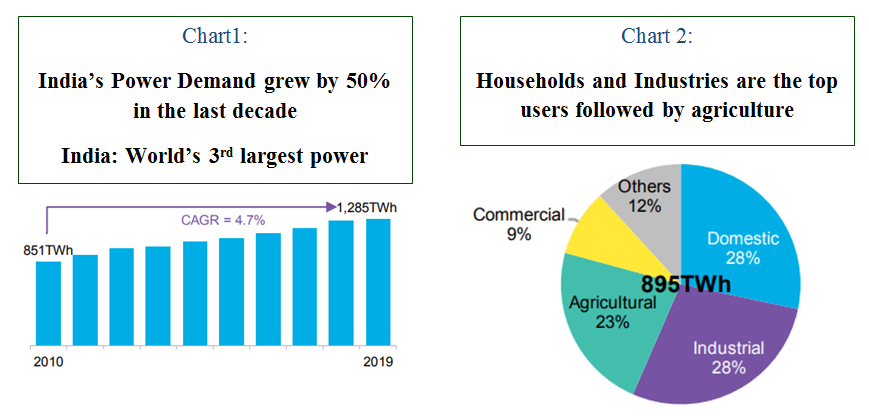

It is very likely that clean energy revolution is here and state and national governments are at forefront trying to make a difference. This perception is based from a mixture of past favourable policies, regulations, incentives and innovations in the power sector. The pace of adoption might differ in different countries but I believe, it is expected to be one of the hottest sectors in the coming decade. The momentum of adopting the green energy has build up in last 4-5 years and the next 5-6 years might be the accelerated phase in renewable energy sector in India and globally too.

In June 2020, Goldman Sachs mentioned that spending for renewable power projects will become the largest area of energy spending in 2021. The main driver of this is the diverging cost of capital.

In 2019, the European Investment Bank (EIB) announced that it would end financing for fossil fuel energy projects from the end of 2021. They will instead increase their support towards clean-energy projects. Similarly, many private investment banks, including Deutsche Bank, Morgan Stanely, Citi Bank have also tightened their Fossil Fuels Policy. Additionally, big private equity firms are now increasingly putting their investments into decarbonization technologies. For example, earlier this year, Blackstone announced a $850 million solar recapitalization investment in Altus Power.

Continuing cost declines confirm that competitive renewables are a low-cost climate and decarbonisation solution that aligns with short term economic needs and keeping the long-term sustainable goals intact. The more these technologies are deployed, the more their cost could fall.

Also, it could form a key component of economic stimulus packages in the wake of the COVID-19 pandemic. It would be enhanced by these clean, easily scalable and cost effective solutions. It could save money benefiting consumers, good returns to investors and also create numerous jobs.

Staying true to my investment style, I have chosen a company whose product is irreplaceable, playing a pivotal role in the manufacturing process and can be an indirect play on the high growth expected solar energy sector. Over the years, the company has established quality standards and competed with the subsidised import of the top global players in terms of cost. In some way, it can be a huge beneficiary of the rising solar energy sector in India.

Please note that this article is only for informational/educational purposes and in no way meant to be a stock recommendation or financial advice.

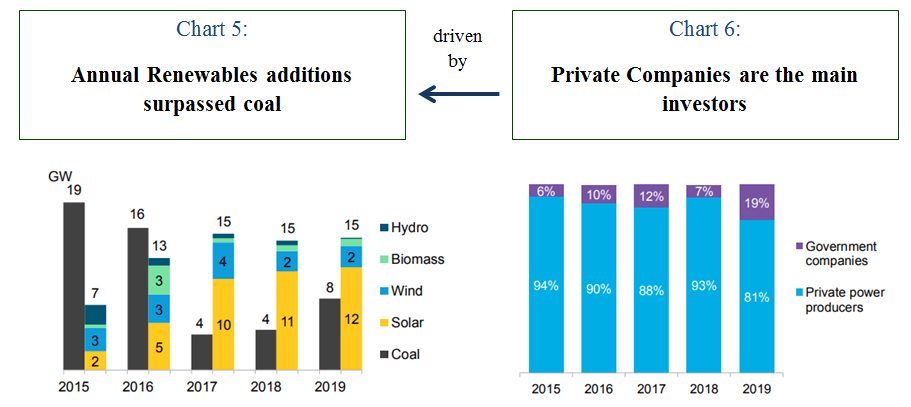

Background: Depicting the transition from Fossil Fuels to cleaner source of energy in Indian Power Sector in charts

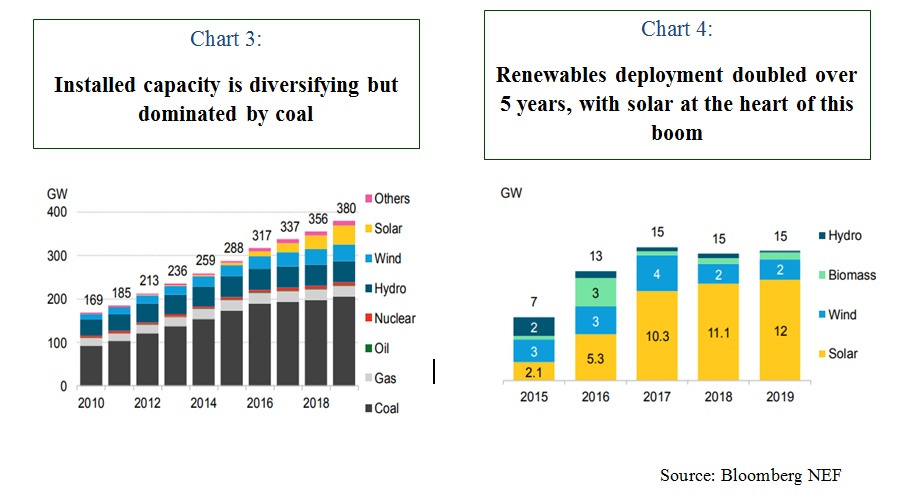

Installed Capacity more than doubled to service the increasing demand

The clear shift to renewables capacity is a lasting one as it is primarily driven by economics. The gap between the costs of new coal versus clean power generation continues to widen in favour of the latter.

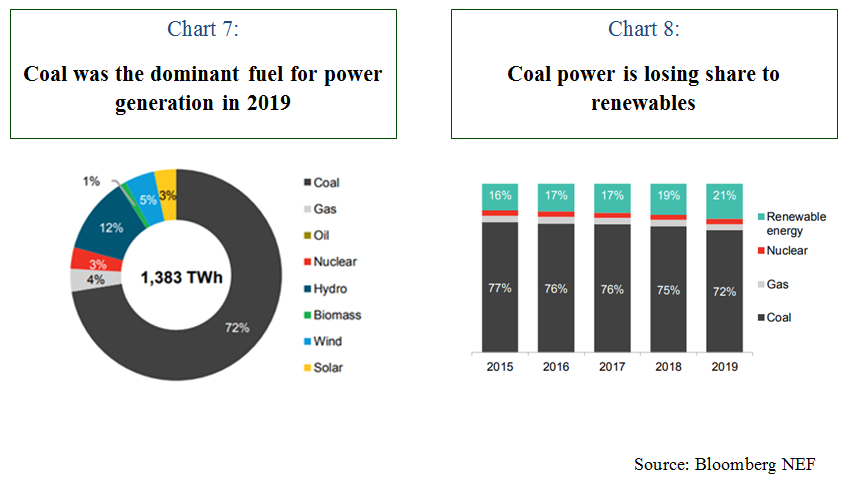

The growth of renewables has started eating into coal’s share of generation

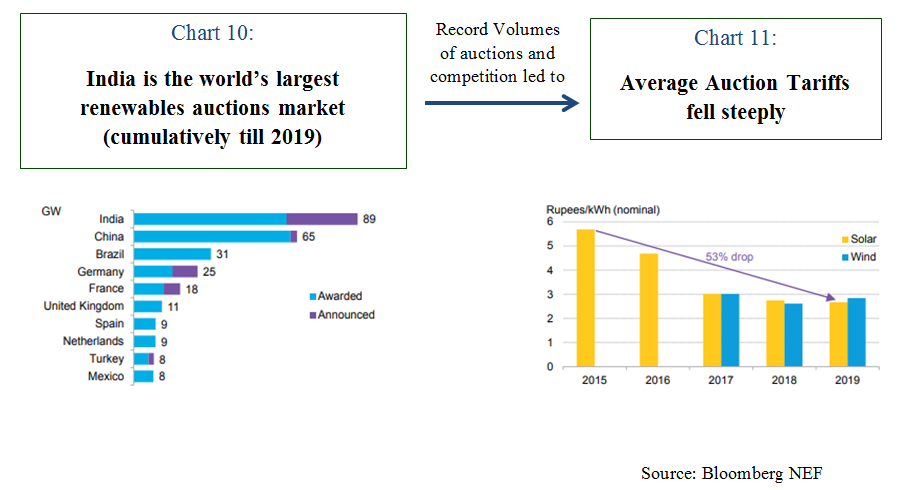

Renewable energy sources (including large hydro) supplied 21% of India’s grid electricity needs in 2019. This share has increased by five percentage points in five years, driven by combined additions in solar and wind of between 5GW and 13GW annually.

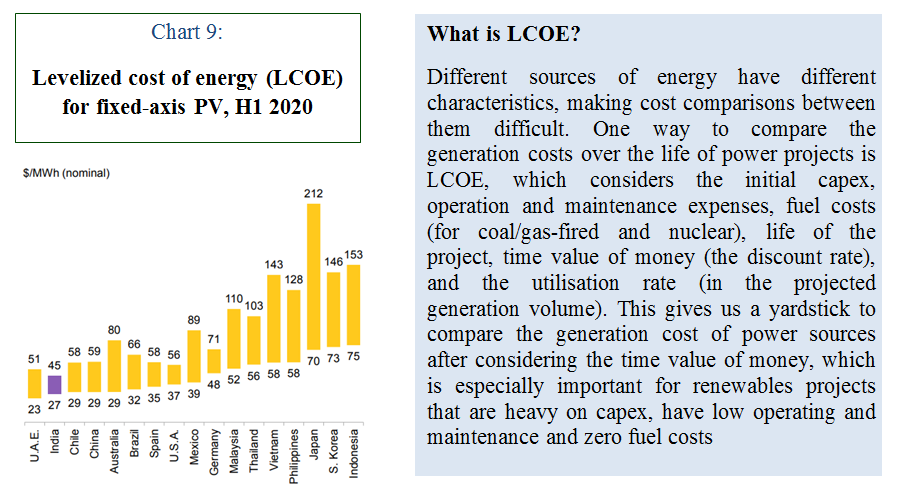

India’s Renewables (Solar) are now among the cheapest in the world

- Cost Parity: Renewables v/s Traditional Source (Coal)

The global average levelised-cost-of electricity (LCOE) f or utility-scale solar photovoltaic (PV) projects declined by 82% between 2010 and 2019, and could see a further 40% fall till 2030, according to data from the International Renewable Energy Agency (Irena). As also seen in the above charts that India’s renewable is among the cheapest in the world. In 2009, Solar used to be expensive and heavily dependent on government subsidies. But now, because of technological improvements, economies of scale solar PV has become competitive. Over the years, China has been phasing out their subsidy programmes because solar has become competitive and to relieve pressure on fiscal budget. But, in India it is dependent on government policies and subsidies to some extent. On cost front, it is set to enjoy higher growth rates.

or utility-scale solar photovoltaic (PV) projects declined by 82% between 2010 and 2019, and could see a further 40% fall till 2030, according to data from the International Renewable Energy Agency (Irena). As also seen in the above charts that India’s renewable is among the cheapest in the world. In 2009, Solar used to be expensive and heavily dependent on government subsidies. But now, because of technological improvements, economies of scale solar PV has become competitive. Over the years, China has been phasing out their subsidy programmes because solar has become competitive and to relieve pressure on fiscal budget. But, in India it is dependent on government policies and subsidies to some extent. On cost front, it is set to enjoy higher growth rates. - Strong Government Thrust and Scheme with Domestic Content Requirement (DCR)

In June 2015, the government had set a target to have 175GW of renewable generation capacity installed by 2022. Of these, solar PV’s target was 100GW, followed by 60GW wind, 10GW biomass and 5GW small hydro. In G20 Summit (Nov 2020), PM Modi said that India will meet its goal of 175 GW of renewable energy capacities well before the target of 2022.

PM Kusum Scheme: 25.7 GW by 2022 with an incentive for farmers to install Solar Pumps etc. using domestically manufactured cells and modules.

CPSU Program: 12 GW of Solar Projects proposed for Phase II grid connected solar PV projects using domestically manufactured cells and modules - National Tariff Policy: Renewable Purchase Obligation

Set Renewable Purchase Obligation (RPO) target of 10.5% by FY2022; increased from 8% target set previously

- Solar Panel manufacturers are now under governments ‘Performance Linked Incentive (PLI)’ scheme which is likely to give a boost to the domestic companies.

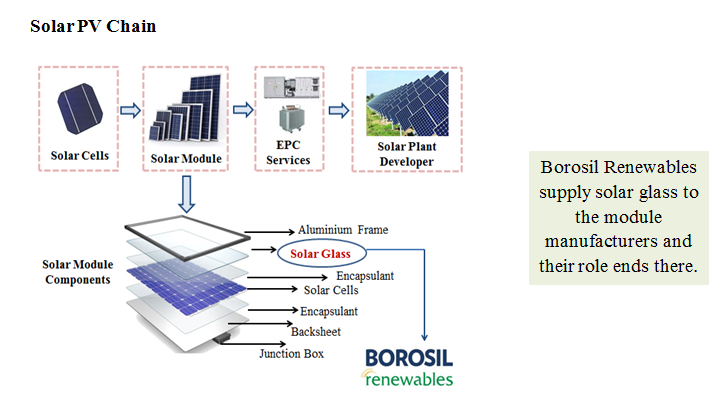

The company is engaged in the manufacturing of low-iron solar glass for application in solar power sector.

Solar Glass: It is a substrate on which the entire module is laid. The key difference of solar glass compared to standard clear glass is that the former is manufactured with lower iron content and produces a much clearer glass structure with no green tint visible through the glass. It has a higher light transmittance of over 90% vs 83% for regular glass, which as a result increases the module conversion rate.

It is an irreplaceable product.

For panel makers, glass accounts for 10-15% of the total cost.

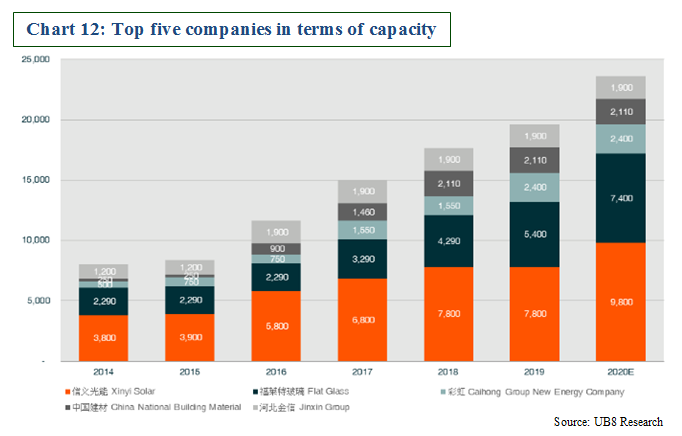

China is absolutely the leader in solar glass manufacturing. The top five Chinese solar glass producers took up a total market share of 68.5% in terms of capacity by the end of 2019.

Solar Glass is a manufacturing business where technology matters the most but the innovation is at a slow pace. Hence, it’s less disruptive in nature in the entire value chain. Over time companies improve yield rate and cost structure. The company needs a stable customers list before thinking of entering the business or doing new capex.

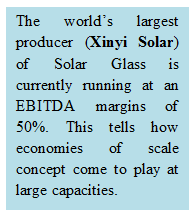

Know-how in lower iron content and yield rate and cost advantages from the economies of scale stopped regular glassmakers to enter this industry to some extent, too. Thus, we do not expect big changes in the solar glass competition landscape in the long term unless great innovations in solar panels appear. The view is based on how the competitive landscape hasn’t changed in China over the years. It is relatively concentrated, Xinyl Solar and Flat Glass, the two biggest players contribute close to half of the market, enjoying higher profitability compared to peers due to economies of scale.

- Threat of New Entrant:

- Raw Material Front:

Soda Ash and Power (Gas, Heavy Oil and Electricity) are the main raw materials used in manufacturing solar glass. Soda Ash is abundantly available in India. It’s an international commodity. Sometimes, it is imported in order to get a better pricing. On this front, there is no entry barrier.

- Capital Intensive, Technical know-how, scale moat and customer relationship play an important role

This acts as a huge entry barrier. It is not easy for new entrants to break in, as glass production is a continuous process that cannot stop for years, it requires stable sales channel before building up any new capacities. Shutdown Cost is very high. The profitability increases as the scale increases. This is probably the reason why we haven’t seen any solar glass manufactures in the country.

Even if new players enter the industry, Borosil will have the first mover advantage in the industry to a great extent in terms of:

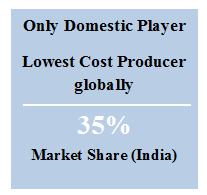

- Borosil is the lowest cost producer in the world. It is unable to compete with the imports because of the export subsidies provided to Chinese players

- Stable Customer Relationships

- Tremendous Experience over the years enabling them to improve their yield rate and cost structure

- The advantage of Brownfield Expansion to Borosil Renewables v/s Greenfield Expansion to new players

- Revenue Model and how are contracts made?

It’s a B2B player. Their customer is a module manufacturer who uses it as a component which is going directly into production. The company cuts the glass according to the customers requirement, temper it, pack it and send it to the customers. The company doesn’t have long term orders. They get orders on a regular basis and fulfils them within 1-2 months.

- Switching Cost for customers is high

Customer stickiness is visible in this industry. Putting a solar project is a long term decision; hence quality assurance is very important. Once the product is approved, customers don’t switch a lot.

- Pricing

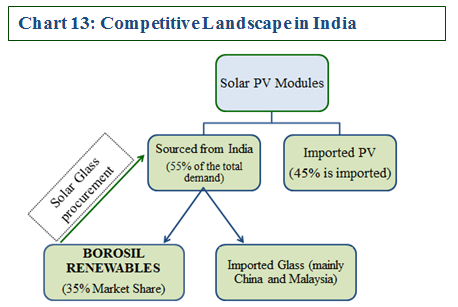

The company isn’t a price setter in the market despite being a monopoly, besides competition from imports. The imported glass is the price setter in the market. The capacity abroad is 40 times the capacity of Borosil Renewables. But, it does have a bargaining power with MSME customers.

- Working Capital Requirements

It is a low working capital requirement industry as compared to the downstream products like Solar Modules manufacturing. Inventory management is less as it is make to order.

- Pay Back period is around 4-5 years. Time taken to build up new facility is around 15-18 months.

- Capex requirement for 500 tonnes/day

Brownfield Expansion: ~Rs. 500 crores & Greenfield Expansion: ~ Rs. 750 crores

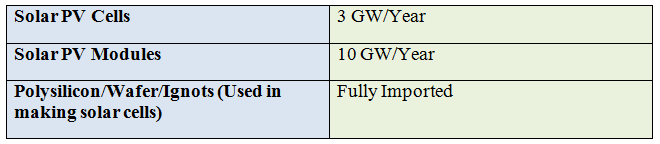

1. Reliance on China for 80% of solar equipment requirements from cells to modules including solar glass.

2. Installed Solar Capacity in India

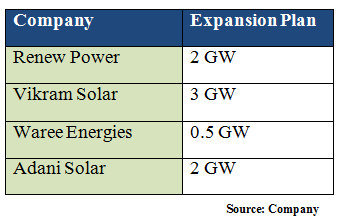

- Existing large module manufacturers have announced plans to add substantial capacities

This will increase the demand for solar glass in domestic markets.

- Anti-Dumping Duty

2017 onwards, Solar Glass Imports from China were subjected to an ADD with SEZ imports being exempted from this. Around 55% of the total modules manufacturing in India is done in SEZs. Hence, they escape ADD and when they come under domestic tariff area, there is no duty levied on them. Moreover, Chinese manufacturers have exporting through Malaysia as there is no duty levied on them.

The company has applied to DGFT for levy of countervailing duty on imports from Malaysia too. The decision is expected to come in mid-Dec 2020.

- Advantage of Sourcing from India

- Leads to better working capital management for modules manufacturers

The manufacturers have to pay 30% advance payment at the time of import. The time of delivery is uncertain to some extent whereas in India, the date is fixed with provision of flexibility of payments.

- If there is any problem in the glass, then it can be fixed within 24 hrs which is not in the case of imports

- Rise in price of Polysilicon

Polysilicon is used to make solar cells. Total global production of polysilicon is 518000 tonnes. The explosion in one of the largest manufacturers in China removed 10% of the total market supply (~48,000 tonnes). This pushed up the price by 50%. The plant is expected to stay offline for nine months.

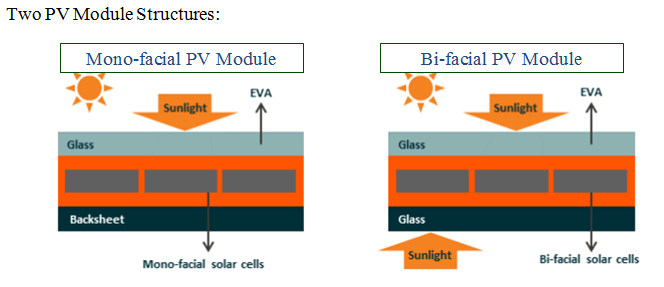

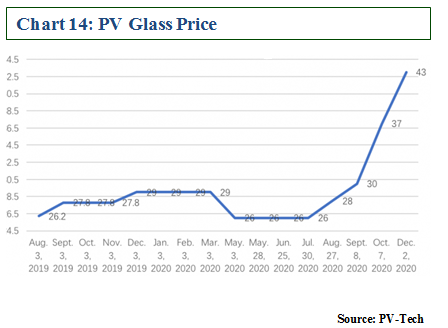

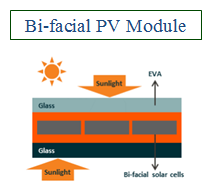

- Move towards Bi-facial model raise solar glass price

The shortage of solar glass globally has raised its price by 71%  since July 2020. The shortage comes as the solar industry turns toward bifacial panels, which increase both power output and glass requirements. Bifacial panels coat both the top and bottom with glass. Such panels are expected to make up half the market in 2022, up from about 14% last year. Due to anti-pollution measures taken by China, glass makers weren’t allowed to expand and some were asked to shut down. This also led to shortage in the market.

since July 2020. The shortage comes as the solar industry turns toward bifacial panels, which increase both power output and glass requirements. Bifacial panels coat both the top and bottom with glass. Such panels are expected to make up half the market in 2022, up from about 14% last year. Due to anti-pollution measures taken by China, glass makers weren’t allowed to expand and some were asked to shut down. This also led to shortage in the market.

- Business Segment: The company is engaged in the manufacturing of solar glass for application in solar power sector.

- Total Installed Capacity and Expansion Plans

- Total Installed Capacity: 450tonnes/day

Currently, the company can cater to 2.5 GW of solar power demand.

- Expansion Plans: The company plans to increase its capacity to 1000 tonnes/day by March 2023 catering to 5 GW of power demand.

The expansion would be funded by a mix of debt and equity. The company recently did a QIP of Rs. 200 crores. Debt would be ~Rs. 180 crores and the rest would be internal accruals.

- Revenue Mix

- Geographic Presence: In FY2020, 77% of the total revenue was from domestic market and the rest was from exports market. European market is the major customer vase for the company.

- 50% of the customers are MSME and the rest are large customers

- Plant Location: Bharuch, Gujarat

The one question that came in my mind while researching on this company was can this company make big and be worth investing because it’s a small company in terms of capacity when compared to the global giants. Inspite of being the only player in the country, the bargaining power is with large customers? Though, it does have huge bargaining power with MSME customers.

By now, I guess even you might have got a similar question.

Just some number crunching, growth visibility in the sector, recent trends and the market position of the company made me believe that the company can perform well in the coming years. Also, over the years the company has established its product and has been able to survive the overcapacity phase in the market. I believe, in the second phase when the industry appears to be in the growing phase, the company can perform well with all the acquired knowledge and experience in the last decade.

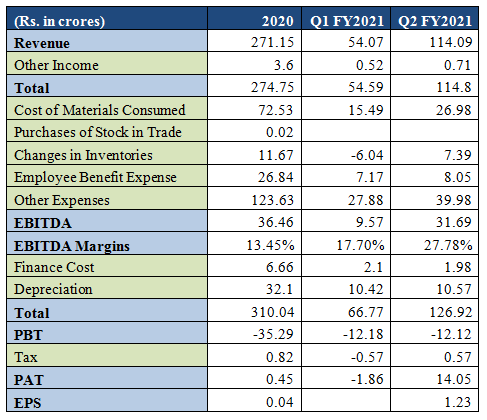

- The company has increased its capacity from 210 tonnes per day capacity to 450 tonnes per day in FY2020. The company re-built the old furnace and also added a new one. Technically, Q2 FY2021 was the first quarter when both the furnaces were operational. This was also reflected in the quarterly result in terms of increased revenue and improved margins.

Please note here that the first furnace was started in 2010. By 2018, the operating efficiency of the furnace reduced which also impacted the margins. Hence, they decided to rebuild the furnace and also added a new one.

From here on, the company is expected to perform well considering good demand visibility with already established cost optimisation measures.

- Expansion in place to double the capacity

The company plans to increase its capacity to 1000 tonnes/day by March 2023. The concept of economies of scale is quite apt in this industry.

- The company has a first mover advantage

If some industry is performing well then it might attract new investments. Even if new players enter, the company will have an advantage on account of cost competitiveness and stable customer relationship. The management has almost a decade of experience in this business.

- Near-term prospects also look bright

The solar glass prices have increased tremendously from August 2020 onwards. The rise in price is due to shortage in the global market. The raw material availability ensured that the prices don’t increase in tandem. If volume remains steady, then the company is expected to perform well in the coming quarters.

P.S.: Major Raw Material is Soda Ash and Power

- Countervailing duty on imports from Malaysia for five years

After antidumping duty was imposed on solar glass from China, they started exporting through Malaysia where there wasn’t any duty levied on solar glass. Now, with duty imposed on imports from Malaysia, the preference of domestic manufacturer would increase in the coming years.

- Delay in pick up in solar project due to:

- Government Policy

The growth of solar energy sector in India is dependent on government to some extent. Any delay or change in policy can lead to decrease in capacity utilisation. Steady volumes are important in this industry to maintain margins.

- Rise in raw material price

The rise in prices of polysilicon and solar glass will in turn raise the price for putting a solar project. So, keep a check if there is any delay in undertaking the projects.

- Solar Glass Industry is highly concentrated and very much dominant by China

The supply shortage is expected to continue in 2021. New capacities are being added in China. One needs to check the dumping of imports in India with increased supply globally.

Borosil Renewables is a part of the Borosil Group Companies. Borosil is one of the top trusted brands in the consumer business.

The company led by Kheruka Group with Mr. B.L. Kheruka being Chairman Emeritus. The company has at least 50% independent directors in the BOD Committee.

The audit committee is chaired by an independent director and majority of members are also independent.

The company doesn’t have any pledged shares.

The company recently did a restructuring in the group companies in 2020 to simplify the structure and reduce cross holdings.

Please note that, the remuneration as a % of Net Profit is high in this company.

*The 2020 figures aren’t directly comparable to previous years because of restructuring done.

The company is the only player manufacturing solar glass in the country. With imposition of duty on imports from Malaysia too, steady volumes can be maintained as the first preference would be choosing domestic player. Also, in some way, the multiplier effect can come to play for the eco-friendly energy source where the price economics is in their favour compared to the traditional thermal plants. Moreover, the technology hasn’t change a lot since many years now. Disruption on this side of the business is less. The company has taken measures towards cost optimisation over the years when the industry was at a nascent stage, developed a good quality product and has been able to compete with the imports for a decade now. Since, the solar energy sector is expected to be in the accelerated phase for all the reasons mentioned above, just thinking if this company can be the beneficiary of the expected up cycle.

Please find the attached pdf file on the same.

The Investing Tales- Borosil Renewables Ltd.

Happy Investing!