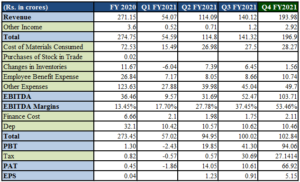

Borosil Renewables Ltd reported very good set of results and were in line with the expectations. If we discuss about the the company’s journey in the past one year, we can infer that the company started reporting good numbers from March 2020, got impacted due to COVID-19 in June-2020, then again pulled up the performance in Sept-2020.

What explains the good results in the last two quarters? Can the company sustain such high margins that were reported in March-21?

The high margins resulted from two factors:

- Higher Solar Glass Price

- Higher Volumes with limited increase in raw material prices

One can read about the favourable trend that persisted in the solar glass industry and also about the prospects of renewable energy sector in the detailed report discussed before. Please find the link of the same below.

In short, it was the advantages of renewable source of energy and the favourable price trend of solar glass.

While I remain optimistic about the prospects of renewable energy sector in the long term especially solar industry but on the other hand, solar glass prices have decreased in the on-going quarter. This has also been confirmed by the management in the conference call. While, the first factor will take care of the volumes, the trend in the other tells us that the margins will normalise going forward.

The analysis of results over the past one year do tell us that volumes are key to good results. However, in short term, I believe volumes might get impacted owing to delay in execution of solar projects due to partial lockdown in the country.

Key Takeaways from the Conference Call

- Realisation of Solar Glass

Prices have come back to normal levels. The realisation has come down from Rs. 155 in Q4 FY2021 to Rs. 115 in the on-going quarter as per the management guidelines. The current price is 15-20% higher than the prices that prevailed in the beginning of 2020. The majority of the profitability in Q4 FY2021 was due to price realization. It contributed around 80-85%. The prices have come down not only due to new capacities coming up in China but also due to low demand in China because the new policy from the government hasn’t come up yet .

2. Solar Modules Capacity in India

The current capacity of solar modules is around 11 GW in India. The utilisation in 2020 was around 4 GW only. The reduced utilisation rate was due to low availability of workers and other pandemic related restrictions. It is expected that this year the utilisation rate should be higher than last year subject to uncertainty related to pandemic restrictions. The new capacity of about 13 GW is expected to come up in next 1-2 years.

3. Exports and Extension of Duties

The company has benefited from duties and PLI scheme as guided by the management. They have requested the government to extend the anti-dumping duty charges for 5 years. They also mentioned that other countries are now looking for procuring solar glass from non-Chinese companies and they could be one of the beneficiaries.

Other Points:

- New Expansion

- Total installed current capacity: 450 TPD

- Total new capacity due in July 2022: 550 TPD

- Additional new capacity due in 2023-24: 1000 TPD

- New Manufacturing Facility of Solar Glass to come up in India

- Gold Plus Glass Industry, an Indian float glass manufacturer plans to set up a new solar glass factory with a capacity of 300 tonnes per day. The plant will be built in Southern India and will be operational in Sept-2023.

- According to news articles, Longi the leading solar glass manufacturer in China and the world is planning to set up solar glass capacity in India. The acquisition of land in the country to set up local manufacturing operations has been completed.

Financials

Note:

- There was a higher tax expense incurred in Q3 FY2021 due to which impacted the bottom line.

Conclusion

Overall, I remain optimistic on renewable energy sector as a whole especially solar energy in the long term. As explained in the detailed report too, global money is chasing this sector and the trend is bound to establish in India too. But, at the same time I also think that because of uncertainty related to pandemic restrictions, we might expect a slight decline in volume due to delay in execution of projects in near term.

Disclaimer:

I am not a SEBI Registered Analyst. The views expressed therein are based on information available publicly/internal data/other reliable sources believed to be accurate. The information is provided merely for educational purpose only and in no way meant to be a stock recommendation. Do your own due diligence or consult a SEBI registered financial advisor before undertaking any investment decision.