More than a decade back, masalas used in making curries and vegetables were typically made at home. Now ready to cook masalas are an integral part of Indian households. The ready to cook idli/dosa batters have surely reduced cooking prep time and also made it easy to cook Indian delicacies at home. The 2-minute instant maggi noodles have managed to enter Indian homes on their promise of convenience and consistency in taste over the years. Maggi was launched in India targeting the working women in 1980s. Now, for most it’s childhood in a bowl. There are so many memories attached with a packet of instant noodles. When Dominos introduced Pizza in India, it wasn’t a ready market. One of the major factors that led to enormous growth for Dominos was its policy of home delivery in 30 minutes or free guarantee. One common message in all the above mentioned examples is that Indian households do give immense importance to convenience, time and effort. If one needs to change a particular behaviour, the product has to offer extra benefits like less efforts involved and convenience.

All these examples also make me believe that Ready to Cook market in India which is at a nascent stage has immense potential to grow. Just unwrap the pack, simmer for a few minutes and the steaming food is ready on the plate. It’s that simple and convenient.

The concept of convenience food has been prevailing in developed nations since a long time. Indian kitchens still prefer home-cooked meals over convenience, but will that change soon? This report aims to answers this question.

Ready to Cook Market: India

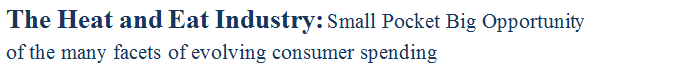

Ready to Cook market in India stands at INR 2100 Cr in 2019 and the market is expected to grow at a CAGR of 18% to reach INR 4800 Cr by 2024.

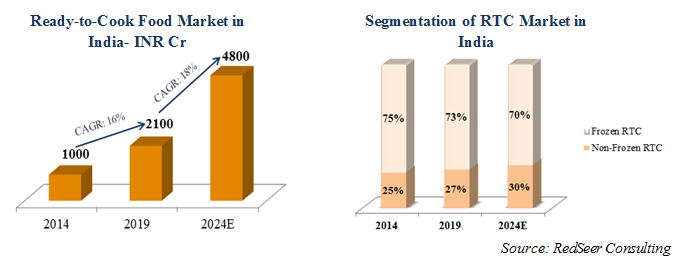

Spending Patterns Evolve

Consumption stabilizes once a certain income level is reached

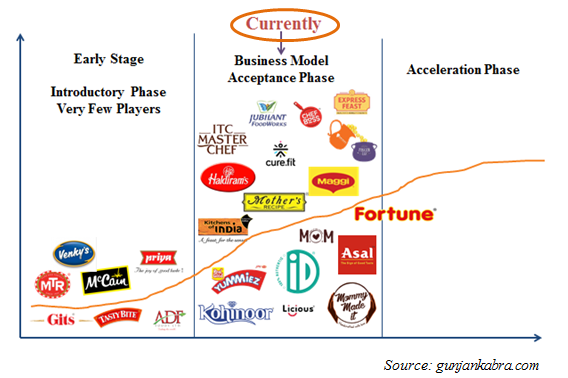

Evolution of the Indian Ready-to-Cook Industry

Ready-to-Cook meals are addressing market gaps efficiently

The average cooking time in the US is down to 30 minutes per day. Every sub-segment of convenience foods is on the rise such as breakfast snacks, frozen snacks, ready-to-eat foods and grab-n-go.

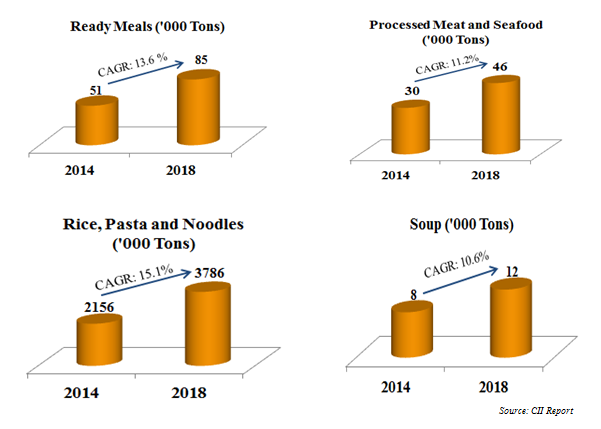

India’s Sales Volume of Packaged Foods in 2014 and 2018

For the last 12 months, ending 30th June 2020, MTR had a turnover of Rs. 9.2 billion. It has increased five-fold since 2007.

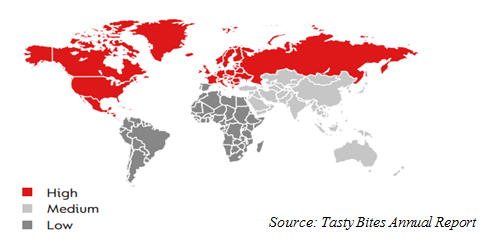

Ready-to-Eat Food Market (Region wise Penetration)

Factors shaping a growing market for ready-to-cook industry

North America is the biggest market for ready – to – eat meals accounting for 42% of the global RTE market share. Growth in North America is attributed to various factors such as improved standard of living, growing working population and increasing per capita income. Moreover, rapid urbanization and increased employment levels have contributed to busy schedules which increased the demand for Ready – to – Eat food.

The Indian consumer behaviour is greatly influenced by the West. India provides a high growth opportunity in this sector. The growth is linked to the changing demographics of urban India. Young working couple and students look for easy dinners and it can be a valid alternative to pizza, instant noodles or food ordered on foodtech apps.

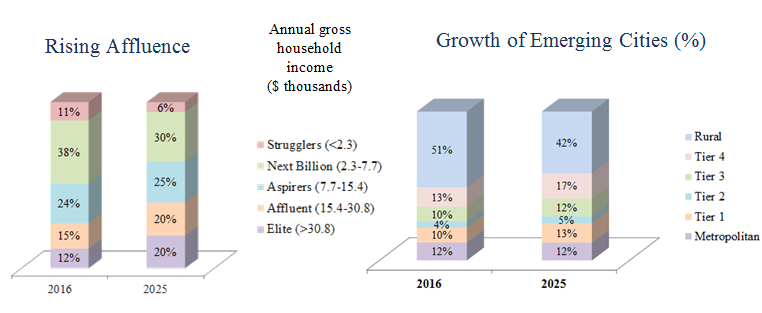

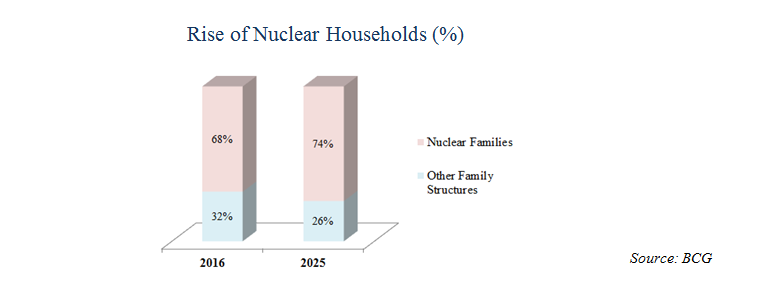

Behind the growth headlines of these factors, there is an important story of how the consumption behaviour and expenditure patterns change as the society evolves and income rises. These shifts can play an important role in growth trajectory of many businesses.

Aspects of India’s fast-growing consumer market

All these factors cumulatively lead to time compression. The fast-paced work combined with shrinking family structure, need to perform increasing amount of work within a stipulated time period has created heightened sense of time compression. This is driving exponential growth in several business models providing convenience such as ready-to-cook and ready-to-eat products.

- Availability is the key issue

In economics, Say’s law says ‘Supply creates its own demand’. It’s aptly applicable here that ‘availability creates demand’.

Currently, the majority of RTC food market is concentrated in Metro and Tier 1 cities owing to high purchasing capacity, higher standard of living and busy lifestyle. Also, the products are mainly found in supermarkets and big departmental stores owing to refrigeration requirements for frozen RTC limiting the availability. Also, there is a lack of proper infrastructure to supply and store such products in the retail shelf. However, with improving cold chain infrastructure and investments by traditional stores will provide the necessary impetus to the overall growth.

In one of the interviews P.C. Musthafa, CEO of ID-Fresh stated “When we started, the market for ready-made batter was 300kg per day. Today its 40,000kg per day in Bengaluru alone. This is how when people didn’t believe in the concept of ready-made barter, availability created demand for them.

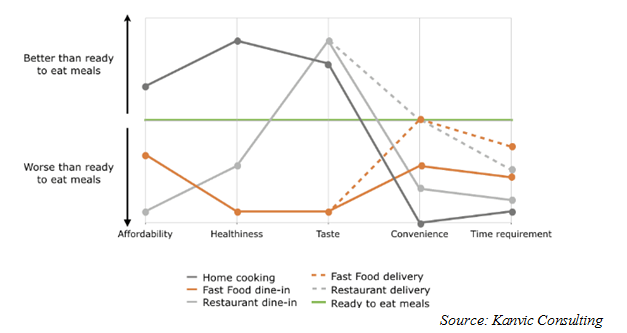

2. It’s a small category in India partly because of strong preference for fresh food or home cooked food in the Indian households.

Majority of Indian consumers prefer homemade food, which is one of the major challenges in the Indian ready-to-cook food market. This is slowly changing as evident from the growth in sales of ready meals in last 5 years. In the long run, the overall pie of ready to cook products is expected to increase.

- Barriers to adoption towards Ready to Cook Food

Indian consumers are extremely concerned about freshness, preservatives and hygiene. The brands should communicate and focus on these attributes and spread awareness. This will help in building consumer trust towards the new category.

- Finally, the most important thing is affordability

In terms of affordability, it is placed at a better position when compared to restaurants. But, it is still not a preference over home cooked food. It comes at a premium mainly because of reduced volume. Since, the volume is less, cost of operations are high. When the company achieves economies of scale in terms of higher volume, the benefits of operating efficiency can be passed on to customers in terms of lower prices.

The past couple of years as discussed above have seen a kind of consumer acceptance for convenience food nationwide. Can COVID-19 accelerate this trend?

The pandemic and the lockdown have brought a surprising new impetus to the business. With restaurants shut, mounting concerns on food hygiene, a store bought RTE meals seems to be a safer and easier option for many people in the country.

Surge in sales as India stayed at home: Numbers reported by the companies during the lockdown period

ID-Fresh Food has seen paratha sales rise by 60% in Q1 FY2021 compared with the previous quarter. E-Commerce sales have doubled for them.

MTR Foods has also seen the demand for its breakfast and dessert mixes and ready-to-eat meals increase by over 20 per cent during the period.

Sea food brand Licious has seen a more than 300% jump in safe ready to eat meat spreads, a two-fold increase sale of ready-to-cook kebabs, marinated meat and seafood.

Express Feast has seen 200% increase in sales during the lockdown.

Grofers has seen a 1.7 times increase in shoppers for ready-to-eat/cook items sales.

Near.store, an e-commerce platform has seen 3x jump for frozen food such as parathas during the lockdown.

The increase in sales is because of most people working from homes, restaurants being shut, consumers stocked up and unavailability of house help. The substantial decrease in out of home consumption, people looking out for convenience and restaurant like food has led to increase in demand for ready to cook food. But, what I also infer from this is there are many new users added to the list. This has surely widened customer base for these companies and more business is expected in this sector. Is 3 months of lockdown and social distancing becoming a way of life enough to develop a new habit? Is this a structural change or temporary? This is difficult to predict in certainty as human behaviour is involved.

In one of the recent interviews, Sanjay Sharma, CEO of MTR Foods gave a guideline of 15-18% growth this year and also mentioned that the sale of dessert mix (particularly Gulab Jamun) increased by 50% during the lockdown.

Picking up the consumer trend, not only food chains like Rebel Foods (Faasos, Smoke House Deli) but also home based kitchens introduced DIY meals and are clocking recording sales targeting consumers who are cautious about ordering cooked food and when home-cooking is at fore-front.

Also, there has been a change in the mix of distribution channels. Some companies have seen a rise in contribution from e-commerce while the others have also tied up with foodtech apps (Swiggy, Zomato, Dunzo) to expand its presence during the COVID times. This makes it highly likely that people might adopt RTC products even for occasions when they order cooked food from outside.

Jubilant FoodWorks Ltd under the brand ‘Chef Boss’ entered ready to cook pastes and sauces market capitalizing on the growing home-cooking trend in India in Aug 2020.

ITC Master Chef: In Dec 2019, ITC announced its plan to garner 20% of the frozen food market in India in next three years which currently ranges between 5-15%. The company has recently made a foray into the frozen food segment under ITC Master Chef brand targeting both retail and food services players. The company’s growth in the category will be on the back of expansion of the range that it is offering. It has presence in 60 cities under the food service portfolio and 11 cities in retail outlets. In the next three years 60 is expected to reach 100 and beyond and 11 is expected to reach 30.

Swiggy’s parent company Bundl Technologies has invested Rs. 31.2 crores in ready to cook food start up Fingerlix. It provides ready-to-cook products such as batters, mixes, curries, dals, parathas and fully ready accompaniments.

After becoming a household name across the country through Maggi, Nestle enhanced its presence in ready-to-cook segment by introducing instant poha and upma in Dec 2019.

Gourmet meat start-up Licious raised $30 million in a Series E round, led by Singapore-based Vertex Growth Fund in Dec 2019. The funds raised will be deployed towards expanding presence in a greater number of Indian cities and powering new product launches, especially in the Ready-to-Eat category.

The sauce brand Veeba entered ready to cook industry providing restaurant style gravies and curries in Aug 2020.

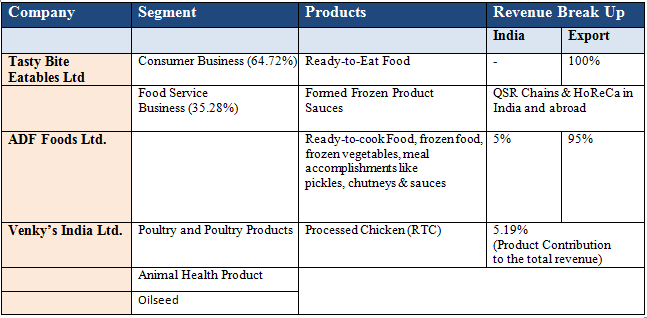

Tasty Bites and ADF Foods entirely cater to ready-to-cook segment and majority of the company revenue comes from exports.

Please find the below link for pdf file on the same.

The Investing Tales- Ready To Cook Industry India

Happy Reading!